Closing The Financial Literacy Gap in the Black Community

African Americans have struggled for decades to build wealth in America. Historical injustices — including slavery, systematic inequality, employment discrimination, racist housing policies, and other barriers — have stymied economic well-being and harmed retirement confidence in the community.

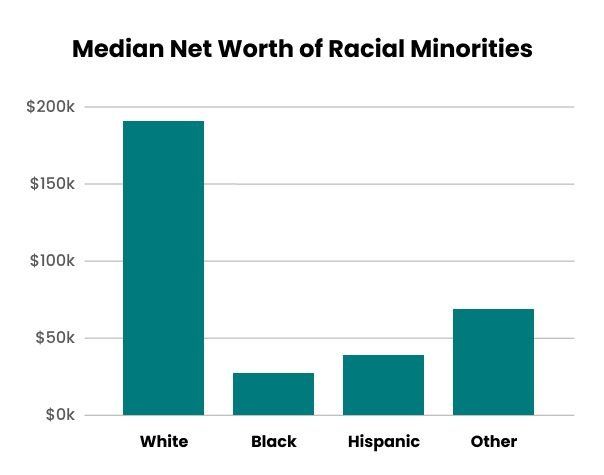

Today, the average white family has eight times the wealth of the average Black family, according to the Federal Reserve’s 2019 Survey of Consumer Finances. The survey is conducted every three years.

Closing the racial wealth gap in the United States is a complex issue with no one-size-fits-solution. But expanding financial literacy, education, and job training efforts can help, experts say.

In 2019, white Americans had a median family wealth of $188,200, while Black Americans had a median family wealth of just $24,100.

Lawrence Gonzalez is an auditor for the U.S. Department of Treasury Office of Inspector General in Washington D.C. who says healthy conversations about personal finance often don’t exist in Black culture.

“People never wanted to discuss money, understand it, or grow it,” Gonzalez told Annuity.org. “There’s almost a mysticism around it because not enough people understand the concepts.”

Raised in Port-au-Prince, Haiti with Brazilian roots, Gonzalez excelled at math at an early age. He came to the United States when he was 11 years old and graduated with a degree in accounting from the Florida State University.

After starting his career, Gonzalez wanted to give back to the Black community. In 2018, he started a financial literacy platform called the Neighborhood Finance Guy to share practical knowledge about eliminating debt and building personal wealth.

Gonzalez says leveraging experiences common to Black culture can help break down barriers to financial literacy.

Educating Early

Raising public awareness is important — but so is teaching students financial literacy in public schools.

Yet a patchwork of state laws, coupled with funding issues and limited training for teachers, has made financial literacy education in schools inconsistent at best and nonexistent at worst.

Twenty-five states required students to complete a personal finance course before high school graduation as of 2022, according to the Council for Economic Education. And 25 states require an economics course to graduate. Some of these states overlap.

However, the size and scope of mandated high school personal finance classes vary. Only six states require students to complete a semester-long, standalone class. Other states offer a shorter course or fold curriculum into a different class.

Research indicates that mandated education requirements make a difference.

College students who undergo state-mandated financial education in high school are more likely to apply for financial aid, more likely to borrow fewer private loans and less likely to carry a credit card balance, according to a study from the National Endowment for Financial Education.

How Financial Literacy Impacts the Black Community

Financial literacy is made of several components. The 2022 TIAA Institute Index study assesses financial knowledge in eight key areas.

8 Areas of Financial Literacy

- Earning

- Consuming, such as budgeting and managing expenses

- Saving

- Investing

- Borrowing and debt management

- Insurance

- Comprehending risk and uncertainty

- Recognizing trustworthy sources of financial information and advice

Borrowing is where African American financial literacy is highest, according to the study, while knowledge about insurance is the lowest.

Borrowing and Managing Debt

Brandy Baxter, an accredited financial counselor and founder of Living Abundantly Coaching and Counseling in Dallas, knows first-hand how a lack of financial education can impact young adults.

When she was in college, Baxter amassed thousands of dollars in credit card debt. She fell victim to enticing offers at a freshman academic fair, a common occurrence prior to 2009 legislation that brought sweeping protections to young credit consumers.

Building a credit score, taking out student loans and paying down credit card debt are aspects of financial literacy many people encounter relatively early in life.

But many Black Americans still struggle with debt. About 54 percent of Black Americans report having no credit or a poor to fair credit score below 640, according to a 2021 survey of 5,000 U.S. adults conducted by Credit Sesame.

In contrast, just 37 percent of white Americans report having poor or no credit.

The survey also found that 30 percent of Black Americans say they were misinformed or tricked in their first interactions with credit, compared to 18 percent of white Americans.

Comprehending Risk and Uncertainty

Financial risk is often a necessary strategy that is seldom understood by most individuals unfamiliar with finance. Investing money in the stock market is a risk. So is purchasing a home or taking out student loans for college.

When you take a financial risk, you know the potential outcomes in advance. For example, if you buy a stock, you know it might lose value.

Uncertainty is when the potential outcome of future events is entirely unknown. For example, people have yet to learn what the U.S. economy will be like in 10 years.

Insurance is a risk management tool and a hedge against uncertainty. It can be used to protect against financial loss.

Yet insuring is the least understood area of personal finance among African Americans, according to the TIAA Index study. Comprehending risk, investing, and identifying go-to sources of financial information follow close behind.

A lack of insurance, or inadequate coverage, can be financially devastating if an emergency arises.

According to a 2020 study by Haven Life, an insurance company, Black Americans are slightly more likely to own life insurance than white Americans.

However, the national survey also shows the median value of life insurance policies held by Black Americans is substantially lower at just $50,000, compared to a median coverage amount of $150,000 for white Americans.

Years of discriminatory practices have fueled this gap, according to survey researchers. Without adequate life insurance, Black families may struggle to pass along wealth to the next generation.

“There’s a lot of confusion about insurance vehicles and a lack of education,” Baxter said. “You have to know how to protect your assets.”

Socioeconomic and Cultural Barriers

Socioeconomic and cultural influences can make financial literacy seem out of reach to members of the Black community.

Grammy award-winning rapper, 21 Savage, grew up in some of Atlanta’s poorest neighborhoods. The 29-year-old reportedly didn’t open his first bank account until he became a rapper.

“I knew there had to be a way to understand how to make and save money— but no one was teaching me that in my Atlanta schools,” 21 Savage wrote in an August 2020 op-ed for Time Magazine.

The rapper notes the persistence of myths surrounding wealth and distrust of financial institutions as hurdles to closing the racial wealth gap.

In 2018, 21 Savage launched a financial literacy campaign called “Bank Account,” a nod to his 2017 hit.

Two years later, he partnered with Chime, a mobile bank, to further expand financial literacy resources to young people. The online course features lessons in banking, budgeting, managing credit and more.

For the popular rapper, financial literacy is a gateway to success and stability.

“It can help free youth to focus on the more important things in life,” 21 Savage wrote in 2020.

The Role of Black Financial Advisors

There is a significant lack of Black representation in the financial planning industry. In 2020, less than 2 percent of U.S. certified financial planners (CFPs) were Black.

While other financial designations exist, such as accredited financial counselors and brokers, data on minority representation in these professions is virtually nonexistent, making it difficult to track the industry’s overall progress on racial diversity.

Increasing the number of Black financial advisors is important, experts say. One potential benefit is attracting new customers from minority communities who may feel more comfortable working with an advisor of the same race.

“If you’re Black and you walk into an institution where no one looks like you and people are using technical terms you don’t understand, the entire experience can feel intimidating and demeaning,” Baxter said.

After serving in the military, Baxter was inspired to grow her financial knowledge, and ultimately started her own financial advisory company.

But she soon realized, “I wasn’t meeting a lot of people in my field who looked like me.”

In 2017, Baxter co-founded Black Girl Financial Magic, an organization dedicated to promoting women of color in the personal finance industry. Baxter said building a professional network has been beneficial to both advisors and their clients.

But knowing when and how to pick a financial advisor can be daunting.

“In Black culture, people aren’t used to paying for trusted financial education,” Baxter said. “Often they don’t understand the benefit.”

Baxter recommends people start with their banking institution.

Major banks — such as Bank of America Corp, Fifth Third, JPMorgan Chase & Co. and others — offer financial literacy programs and initiatives, from free online resources to hands-on programs for high school students.

It’s also important to check a financial professional’s credentials. Anyone can call themselves a financial advisor, but those with legitimate certifications undergo specific training and education requirements.

The Black Physicians & Healthcare Network is not only committed to improving Black Health but also to bridging the financial literacy gap and well-being.

Follow us for more content, as we will help you stay informed and aid you in achieving a better quality of life.

Credit Rachel Christian, Lee Williams "Financial Literacy in the Black Community",

https://www.annuity.org/financial-literacy/black-community/